From Robotics to FinTech: How an ETH Alumni is reviving dead capital with Evorest

February 27, 2025Switzerland is a country of renters – we all know rental deposits. Signing a physical form, sending it via letter and then putting down 3 months’ rent into a low-interest account? There should be a better way – with Evorest there is!

Co-founded by Felix Graule – an ETH Alumni – Evorest built a win-win solution for tenants and property managers alike. Here is how.

From Robotics to FinTech

Felix studied Electrical Engineering at ETH in his Bachelor and Robotics in his Master degree.

“So how did you end up as the CTO of a FinTech then?”, one might ask. It’s a fair question. The answer is tricky:

- Graduating from a school like ETH opens many doors – including some odd paths for a Robotics engineer like joining the Boston Consulting Group. But this is where Felix met Gianluca and Marc, who both studied at the University of St. Gallen. Whatever ETH Alumni do after their studies, they will likely work with talented and driven colleagues – and opportunities might open unexpectedly.

- ETH teaches its students solid analytical thinking and structured problem-solving. One might not solve a differential equation every day as a start-up CTO, but it is critical to understand new things quickly. The software must scale? Learn how to build in the cloud. The UI needs a fix? Figure out how to write front-end code. A customer wants to connect their data? Build an API for that.

- Studying at ETH makes you realize that small, motivated teams can achieve a lot – just like the study group that gets you through the ‘Basisjahr’. It takes courage to jump from a steady job to a company that might just be an idea and a motivated team.

“But why in a FinTech and not Robotics?”, one might insist. Again, a fair question to which Felix would answer:

“I believe ETH Alumni can be great start-up co-founders – also outside of Deep Tech. There is plenty of problems in the modern world that can be solved without cutting edge research. Yes, it might not be as glamorous, but it’s incredibly rewarding to build a piece of tech, get it to real customers and see it grow from tens to thousands of users.”

About Evorest

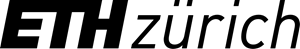

Instead of relying on physical paper forms, Evorest enables rental deposits to be opened and closed fully digitally within minutes. This saves time, especially for property managers. To enable this, Evorest built a Web-based SaaS solution with API integrations to most common software tools used by property managers. Evorest is already working with more than 50 property managers across Switzerland and is on a rapid growth trajectory.

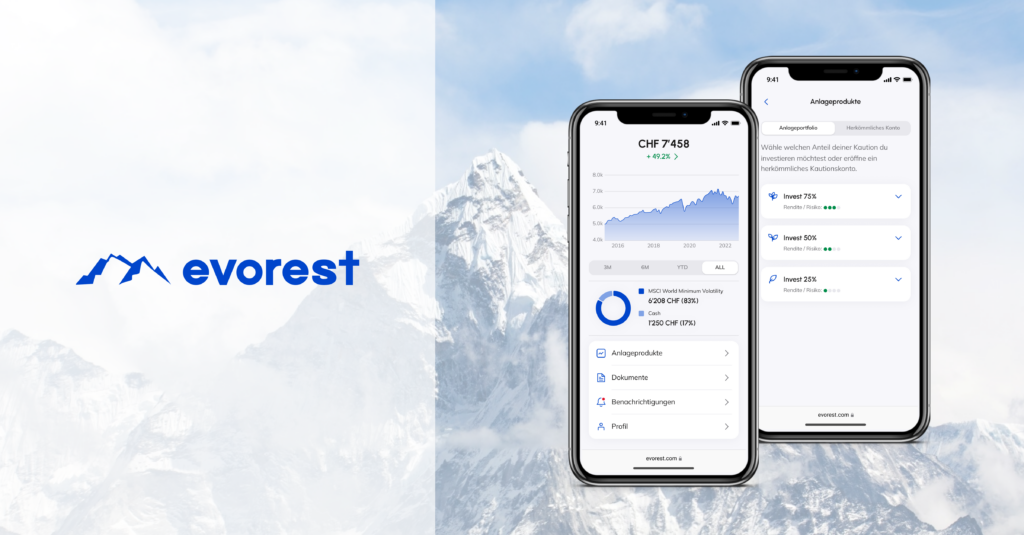

Evorest offers tenants both a conventional cash deposit and a novel invested deposit. This allows tenants to invest up to 75% of their deposit into a range of widely diversified ETFs, allowing them to earn a return while living in their flat – rather than the deposit just being dead capital.

Behind the scenes, Evorest opens the bank accounts with Hypothekarbank Lenzburg. Being a regulated bank means that the deposits are protected against default up to CHF 100’000.